|

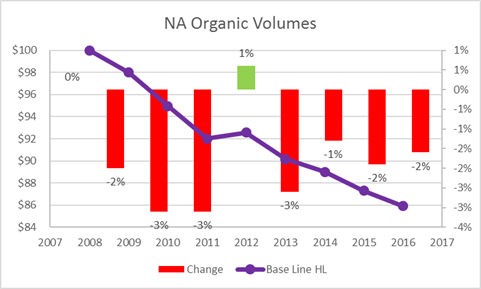

As a public company, you disclose A LOT of information. As a CPA, I ironically HATE that I have to disclose some information to the public, because that info is usually used to criticize management about SHORT TERM performance. I believe in LONG TERM results and strategy. So it begs the question: what long term KPI's do companies share. As a former AB-Inbev employee (I loved working there while I was in STL) I always wondered how our core business was doing: selling beer! Well I decided to look it up now by going back to 9 years of Financial statements for AB. No where in the Annual Financial report does it show a trend of volume, plus it would be impossible to try to compare apples to apples with all the acquisitions they do every year. HOWEVER, there is way: you simple look at each Annual Report year by year and record their "Organic volume of Year over Year comparison." Combine all 9 reports and you get the following for North America (Canada and US) Summary:

- Volumes consistently are down 2-3% a year.. however not as bad as Europe which is more like 4-6% decline. - Cumulatively AB is down 15% North America Volume since 2008. It is the equivalent of producing 100 barrels of beer in 2008 and now producing 85 barrels. Is this bad? Hard to say. Yes they are producing A LOT LESS BEER yet they are bigger than ever. From a short term financial perspective, they are actually doing great because they have been able to raise prices(price), sell higher margin products(mix) and of course cut overhead and production costs like no other. This is why their EBITDA margins are industry leading: 36% at $16.5 billion in 2016! Amazon announced their top 20 "short list" of locations. New media seem to be guessing DC and NYC are top contenders since each metro area had 3 separate cities. It is pretty obvious though the reason they did this: To extract out as much monetary incentives for each city to pit out against each other. Amazon was smart too because each of the 6 cities (including philly as NYC) are in all different states.

I stick too my original list that DC/NYC/BOS/PHL will NOT be selected assuming one of these cities doesn't basically pay for the entire move through tax incentives. Another city that I considered, but didnt put as a top 5 was Atlanta. https://techcrunch.com/2018/01/22/new-study-predicts-atlanta-has-best-shot-at-becoming-amazons-hq2/ I mean yes, it makes sense from raw inputs and has the US largest airport, I just dont see it as a long term strategic "game changing" city when you compare it to similar cities that are on the list like Dallas. As far my top 5: I am going to say all of my 4 made it besides STL which I added on just because of my bias from living there and stated it was a long shot. I say all mine made it, but really I just need to change Cincinnati to Columbus and Charlotte to Raleigh. I blame my minor error by overlooking where the State Capital (tax incentives *cough cough*) are located as well as where all the University talent is. I stand by my order with Denver #1, Austin #2, Raleigh #2, Columbus #4. If I was a betting man, I would totally throw in Dallas to replace Columbus. |

Fav ToolsPowerBI Archives

April 2018

Categories |

RSS Feed

RSS Feed